2016年ACCA考试《业绩管理》备考考点(4)

来源 :中华考试网 2016-05-19

中4 Back-flush accounting

4.1 The basic concepts of back-flush accounting

§ In traditional accounting systems inventory is a key item. Traditional manufacturing firms hold high levels of inventory for raw materials, work-in-progress (WIP) and finished goods.

§ Much of the work of the management (or cost) accountant would be to place a value on this inventory, e.g. using process cost accounting.

§ Back-flush accounting is an alternative approach to cost and management accounting that can be applied where:

- the speed of throughput (or ‘velocity’ of throughput) is high, and

- inventories of raw materials, WIP and unsold finished goods are very low.

§ Instead of building up product costs sequentially from start to finish of production, back-flush accounting calculates product costs retrospectively, at the end of each accounting period.

Illustration 7 – Targeting costs

A key performance target for many banks is to reduce staff costs as a percentage of total bank costs.

The launch of first telephone banking and then internet banking for personal customers (both services enabling bank customers to access their bank accounts, transfer funds and pay bills on a 24-hour basis) has enabled the banks to vary the level of bank staff involvement in the provision of these services and to provide a relatively cost-effective service.

4.2 The accounting aspects of back-flush accounting

§ Back-flush accounting offers an abbreviated and simplified approach to costing by getting rid of ‘unnecessary’ costing records.

§ In the examination you will not be required to perform the double entry for back-flush accounting.

A traditional system

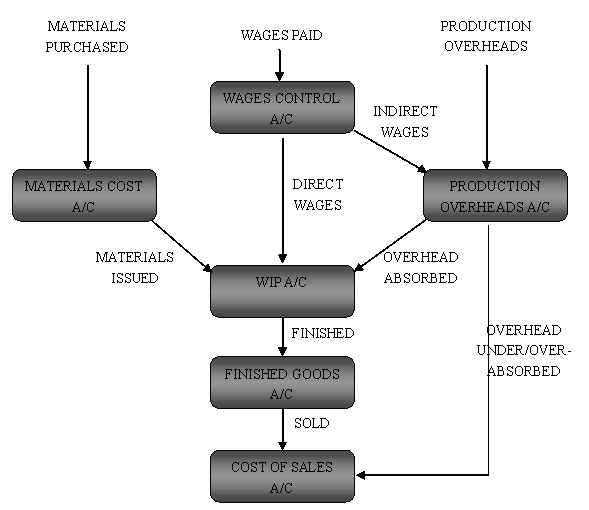

§ A traditional costing system will include the following Τ accounts:

§ The figures for closing inventory in materials, WIP and finished goods are the remaining balances carried forwards after other entries have been made.

§ For example, in the WIP account the value of closing WIP is the balancing figure after the cost of finished goods has been transferred out to the finished goods account.

§ The figures are built up from expenses being incurred through to cost of goods sold.

§ Variances can be calculated at each stage (e.g. materials price, materials usage, etc.)

§ Where process production is involved, these T-accounts will be repeated for each process with the output of one process being the input for the next.

A back-flush accounting system

§ The cost of raw materials is allocated to a ‘raw materials and in progress’(RIP) account.

§ Conversion costs (labour and production overheads) are allocated straight to the cost of goods sold account.

§ At the end of the accounting period an inventory stock-take is carried out to determine closing balances for raw materials, WIP and finished goods. This is quick as there are few inventories. Inventory values are based on budget/standard costs.

§ The closing inventory values for raw materials and WIP are then ‘back-flushed’ from the cost of goods sold account into the RIP account.

§ Similarly the closing inventory value for finished goods is ‘back-flushed’ into the finished goods account.

§ Thus with back-flush accounting there will be a significant reduction in accounting costs albeit at the cost of reduced detail. (e.g. a split of conversion costs between production labour and overhead is not available).

§ However, as noted above, if the production cycle is short and there is only a small amount of WIP at any time, it is questionable whether there is much value in building up detailed cost records as items progress through production. This is key to back-flush accounting.

§ In process production systems back-flush accounting often combines all processes into one.

Test your understanding 8

Target costing is best understood as finding:

(a) What a new product or service actually costs.

(b) The cost of a new product or service of target competitors.

(c) What a new product or service should cost.

Expandable text

Value analysis, otherwise known as ‘cost engineering’ and ‘value engineering’, is a technique in which a firm’s products, and maybe those of its competitors, are subjected to a critical and systematic examination by a small group of specialists. They can be representing various functions such as design, production, sales and finance.

Value analysis asks of a product the following questions:

§ Does the use of the product contribute value?

§ Is its cost proportionate to its usefulness?

§ Does it need all of its features?

§ Is there anything better for the intended use?

§ Can a usable part be made better at lower cost?

§ Can a standard product be found which will be equally usable?

§ Is it made on appropriate tooling, considering the quantities used?

§ Do material, labour, overheads and profit constitute total cost?

§ Is anyone buying it for less than its stated price?

The strategic implications can be measured in terms of a component’s relative cost versus its relative performance. There are four different situations:

1 If a component is both more expensive than and inferior to that of a competitor, a strategic problem requiring change might be necessary. It could be, however, that the component is such a small item in terms of both cost and impact on the customer that it should be ignored.

2 If the component is competitively superior, a value analysis, where a component’s value to the customer is quantified, may suggest a price increase or promotion campaign.

3 If a component is less expensive than but inferior to that of a competitor, a value analysis might suggest either de-emphasising that part or upgrading the relative rating.

4 If a component is less expensive than and superior to that of a competitor, a value analysis might suggest that component is emphasised, perhaps playing a key role in promotion and positioning strategies.

A cost advantage may be obtained in many ways, e.g. economies of scale, the experience curve, product design innovations and the use of ‘no-frills’ product offering. Each provides a different way of competing on the basis of cost advantage.

Test your understanding 9

The Swiss watchmaker Swatch reportedly used target costing in order to produce relatively low cost watches in a country with one of the world’s highest hourly labour wage rates.

Suggest ways in which Swatch may have reduced their unit costs for each watch.

4.3 back-flush accounting and traditional process accounting

Advantages of switching to back-flush accounting:

§ It is a simpler costing system resulting in lower accounting costs.

§ It avoids the need to record production costs sequentially as items move through step-by-step operations in the production process.

§ When inventory levels are low or constant, it yields the same results as traditional costing methods would.

Disadvantages of switching to back-flush accounting:

§ It provides less detailed management information than traditional costing system.

§ A more detailed audit trail is absent.

§ There are additional costs for stocktaking.

§ Extra training is necessary.

Other comments

§ It is therefore appropriate in a mature just in time (JIT) environment where there is a short production cycle, and inventories are low.

§ It is not appropriate for manufacturing environment where inventory levels are high, due to the problems of counting and valuing the inventory at the end of each period.

§ Controlling production is more difficult under back-flush accounting as detail and variance information is lost. Other aspects, such as non-financial target related to quality, need to be considered instead.