2016年ACCAF6(CHN)真题及答案4

来源 :中华考试网 2016-10-25

中Question:

(a)Design Ltd provides computer design services to overseas clients. The company‘s accountant has informed the chief executive officer that there are three alternative value added tax (VAT)policies which Design Ltd can choose to adopt:

(1)Taxable

(2)Zero rated

(3)VAT exempt

The following items from Design Ltd‘s budget for 2016 are relevant to its VAT position:

RMB

Amount expected to be collected from overseas clients in 2016 9,805,000

New computers to be purchased in January 2016 with an expected

useful life of three years with no scrap value. This amount is VAT inclusive

and the supplier is a VAT general taxpayer who can provide a VAT special invoice 3,500,000

Other service expenses in 2016. This amount is VAT inclusive and VAT

special invoices at 6% can be obtained for all items 210,000

Required:

Assuming that there are no other transactions, costs or expenses in the year 2016, for each of the three alternative value added tax (VAT)policies available to Design Ltd:

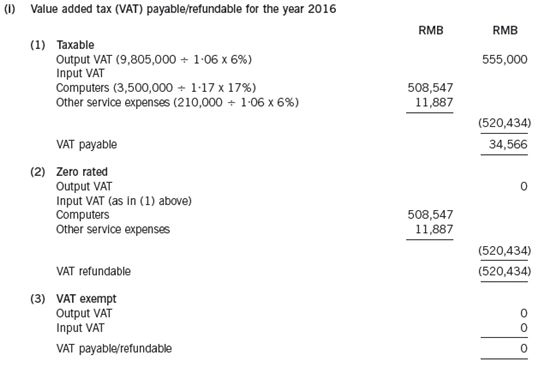

(i)Calculate the amount of VAT payable or refundable for the year 2016. (4 marks)

(ii)Calculate the gross profit for the year 2016. (5 marks)

(b)State ONE major reason for the tax reform of merging business tax into value added tax.

Answer:

(a)Design Ltd

(b)Major reasons for the merger of business tax and value added tax (VAT)are:

- Reduce the tax burden by eliminating double taxation,

- Encourage capital (fixed assets)investment by service industries.