2016年ACCAF5真题及答案3

来源 :中华考试网 2016-09-02

中Question:

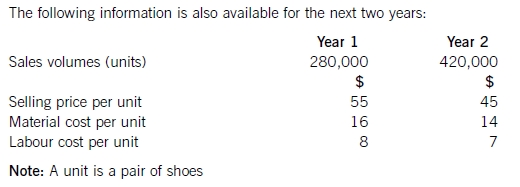

Shoe Co,a shoe manufacturer,has developed a new product called the ‘Smart Shoe’ for children,which has a built-in tracking device. The shoes are expected to have a life cycle of two years,at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology,although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000,which included $20,000 for the salary costs of Shoe Co‘s lawyer,who is a permanent employee of the company and was responsible for preparing the application.

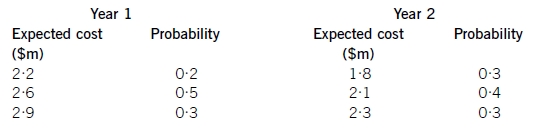

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign,so is uncertain as to what the total marketing costs will be each year. However,the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing,calculate the total expected profit for Shoe Co for the two-year period.

Answer:

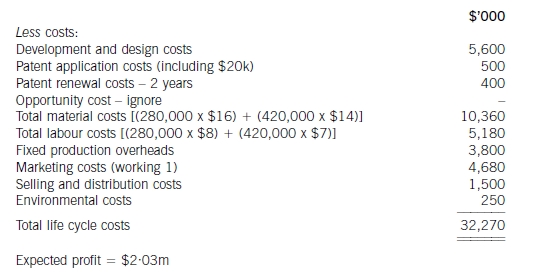

Note

The expected profit has been calculated using life cycle costing not relevant costing. Hence,the $20,000 salary cost included in patent costs should be included in the life cycle cost. Similarly,the opportunity cost of $800,000 is not included using life cycle costing whereas if relevant costing was being used to decide on a particular course of action,the opportunity cost would be included.

Working 1

Expected marketing cost in year 1:(0·2 x $2·2m)+ (0·5 x $2·6m)+ (0·3 x $2·9m)= $2·61m

Expected marketing cost year 2:(0·3 x $1·8m)+ (0·4 x $2·1m)+ (0·3 x $2·3m)= $2·07m

Total expected marketing cost = $4·68m